ESBU Detectives in Bukovyna expose a tax evasion scheme in a well-known franchise store chain, built on “business splitting”

Detectives of the Territorial Office of the Economic Security Bureau of Ukraine in the Chernivtsi region have exposed a tax evasion scheme built on the so-called "business splitting." It was organized by the owners of a network of 24 stores of a well-known franchise that sold frozen semi-finished products. The total amount of unpaid tax liabilities exceeds 20 million UAH, which is an especially large amount.

The investigation established that the network owners acted in prior conspiracy as a group of individuals. They fully controlled the entire activity cycle—from production to product sales. The individuals involved in the case, who were payers of the single tax, Group III, applied the "business splitting" mechanism precisely to minimize their tax liabilities. For this purpose, they used over 30 controlled individual entrepreneurs of Group II, among whom the sales volumes were formally "distributed."

Such a scheme allowed the individuals involved to avoid switching to the general taxation system and evade the payment of VAT and higher personal income tax rates.

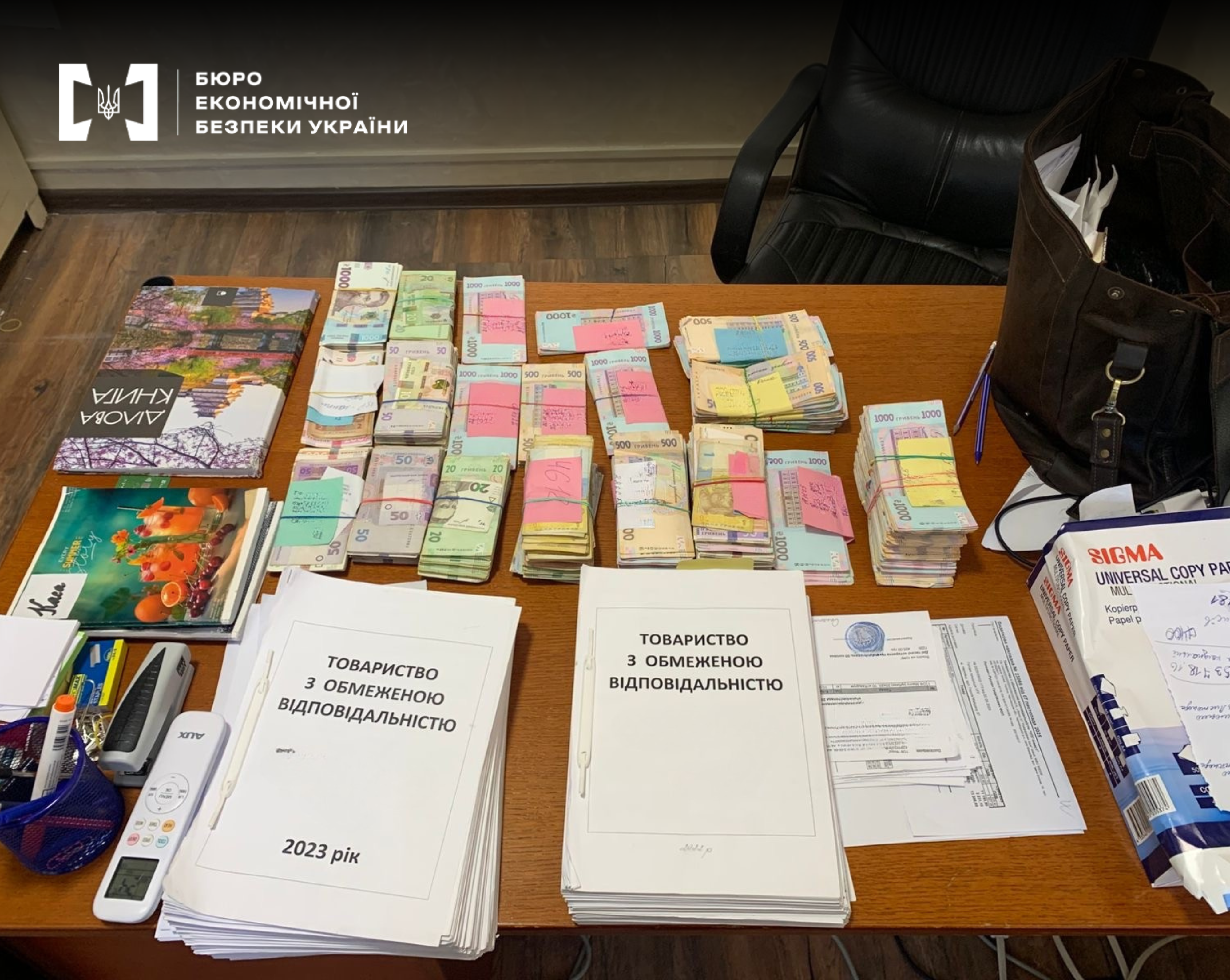

It was also established that a portion of the employees' wages was paid unofficially, in cash, without withholding and paying personal income tax, unified social contribution, and military duty.

During the conducted searches and the study of seized documents, the investigation recorded facts of attempts to legalize illegally obtained funds, particularly through the purchase of movable and immovable property.

The pre-trial investigation is currently ongoing under the signs of a criminal offense stipulated by Part 3 of Art. 212 of the Criminal Code of Ukraine (evasion of taxes, duties (mandatory payments)). The issue of additional qualification of actions under the signs of crimes stipulated by Art. 28 of the Criminal Code of Ukraine (commission of a crime by a group of persons, by a group of persons by prior conspiracy, an organized group or a criminal organization) and Art. 209 of the Criminal Code of Ukraine (legalization (laundering) of property obtained by criminal means) is being considered.

Operational support is carried out by detectives from the strategic economic protection department of the Territorial Office of the ESBU in the Chernivtsi region.

Procedural guidance is provided by the Chernivtsi Regional Prosecutor's Office.